The real estate market has always been a barometer of economic health and societal priorities, with prices influenced by a multitude of factors. In 2024, a confluence of market trends has shaped real estate prices, with implications for homeowners, investors, and policymakers alike. This essay explores the most significant trends driving the real estate market in 2024 and analyzes their impact on property values globally.

1. Economic Growth and Inflation

Economic conditions have a direct impact on real estate prices. In 2024, the global economy showed signs of moderate growth, spurred by technological advancements, infrastructure investments, and post-pandemic recovery efforts. This economic upswing has led to increased consumer confidence and demand for housing.

However, inflation has remained a critical factor. Central banks around the world have grappled with balancing interest rates to control inflation without stifling economic growth. Higher interest rates, aimed at curbing inflation, have increased borrowing costs, making mortgages more expensive. This has tempered demand in some markets, particularly among first-time homebuyers and middle-income families. Consequently, real estate prices have experienced varied trends: robust growth in high-demand urban areas and stagnation or decline in less economically vibrant regions.

2. Urbanization and Population Growth

Urbanization continues to be a defining trend of the 21st century. In 2024, more people are migrating to cities in search of employment, education, and lifestyle amenities. This has driven up demand for housing in metropolitan areas, particularly in emerging economies where urban centers are expanding rapidly.

Population growth, coupled with limited land availability in prime locations, has pushed property values higher. Cities like New York, London, and Singapore have seen significant price appreciation, fueled by both local demand and international investors seeking stable assets. Conversely, rural and suburban areas have experienced slower growth, although the remote work trend has sustained interest in these regions.

3. Remote Work and Changing Preferences

The remote work revolution, accelerated by the COVID-19 pandemic, has redefined housing preferences. In 2024, a substantial portion of the workforce continues to work remotely or in hybrid models, leading to increased demand for homes with dedicated office spaces and better amenities.

Suburban and exurban areas have gained popularity due to their affordability and spacious properties. This shift has resulted in price increases in regions previously considered secondary markets. However, urban areas have not been left behind, as younger professionals and empty-nesters continue to favor the convenience and vibrancy of city living. The result is a bifurcated market, with strong price growth in both urban cores and suburban peripheries.

4. Technology and PropTech Innovations

Technology has been a game-changer in the real estate industry. In 2024, advancements in property technology (PropTech) have made property transactions faster, more transparent, and more efficient. Online platforms and blockchain technology have streamlined buying, selling, and leasing processes, reducing transaction costs and increasing market liquidity.

Moreover, the integration of smart home technology has become a key value driver. Properties equipped with energy-efficient systems, home automation, and enhanced security features command premium prices. Buyers and renters are increasingly willing to pay a premium for technologically advanced homes, particularly in competitive markets.

5. Sustainability and Green Building Practices

Sustainability has emerged as a major influence on real estate prices in 2024. With growing awareness of climate change and stricter environmental regulations, green building practices have become the norm rather than the exception. Energy-efficient homes with solar panels, smart energy management systems, and eco-friendly materials are highly sought after.

Governments and financial institutions are incentivizing green construction through tax benefits and lower mortgage rates for energy-efficient properties. These incentives have spurred demand for sustainable homes, driving up their prices. In contrast, older properties that lack energy efficiency features are increasingly seen as liabilities, leading to slower appreciation or even depreciation in value.

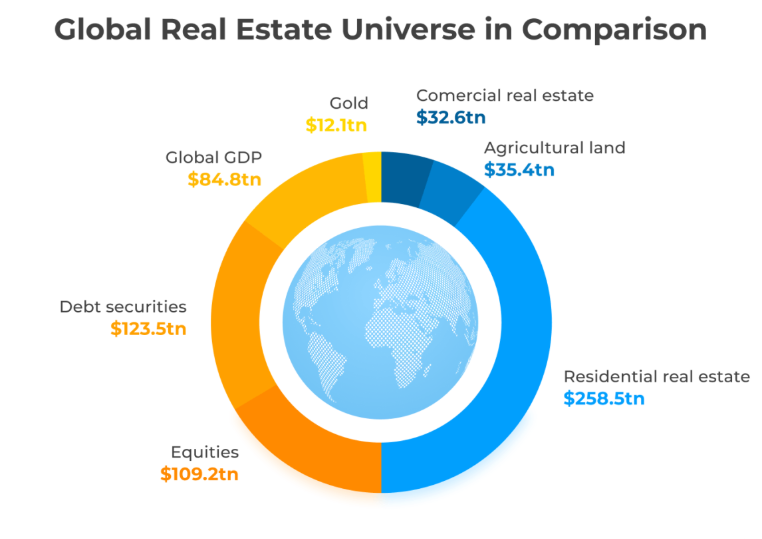

6. Global Investment Trends

Real estate remains a preferred asset class for global investors, providing a hedge against inflation and market volatility. In 2024, foreign investment in real estate has continued to grow, particularly in stable markets with strong economic fundamentals.

The influx of international capital has driven up property prices in global cities. However, geopolitical tensions and regulatory changes have influenced investment patterns. For instance, stricter foreign ownership laws in some countries have redirected investment flows, benefiting markets with more investor-friendly policies. This trend underscores the interconnected nature of global real estate markets and the role of policy in shaping market dynamics.

7. Affordable Housing Challenges

Despite overall market growth, the affordability crisis remains a pressing issue. Rapid price appreciation in major cities has exacerbated housing inequality, making homeownership increasingly unattainable for many.

Governments and private developers are under pressure to address the shortage of affordable housing. In 2024, initiatives such as public-private partnerships, inclusionary zoning, and modular construction have gained traction. While these efforts are critical, their impact on overall prices has been limited due to the sheer scale of demand-supply imbalances.

8. Regional Variations

Real estate prices in 2024 have shown significant regional variation. In North America, strong demand in tech hubs like Austin, Seattle, and Toronto has driven price growth, while markets reliant on traditional industries have seen slower appreciation. In Europe, cities like Berlin and Lisbon have emerged as investment hotspots, benefiting from relative affordability and lifestyle appeal.

In Asia, rapid urbanization and economic growth have fueled robust price increases in cities like Mumbai and Jakarta. However, regulatory measures in China to curb speculative buying have cooled the market, stabilizing prices in major cities. In Africa and Latin America, political stability and economic reforms have played a pivotal role in attracting real estate investment, leading to selective price appreciation.

9. Economic Uncertainty and Resilience

Economic uncertainty remains a wildcard for the real estate market. In 2024, concerns about global debt levels, geopolitical conflicts, and potential economic slowdowns have created a cautious investment environment.

Despite these challenges, real estate has demonstrated resilience, underpinned by its intrinsic value and the universal need for housing. Adaptive strategies, such as diversifying portfolios and focusing on high-growth regions, have allowed investors to navigate uncertainty while capitalizing on emerging opportunities.

10. The Role of Technology in Market Analysis

Artificial intelligence (AI) and big data have revolutionized market analysis in 2024. Predictive analytics and machine learning algorithms enable stakeholders to identify trends and make data-driven decisions. These tools have empowered buyers, sellers, and investors to better understand market dynamics, contributing to more informed pricing strategies.

Conclusion

The impact of market trends on real estate prices in 2024 underscores the complexity and dynamism of the industry. Economic factors, demographic shifts, technological advancements, and sustainability initiatives have collectively shaped property values, presenting both opportunities and challenges.

As the year progresses, stakeholders must remain attuned to evolving trends and adapt their strategies to navigate the ever-changing landscape. For policymakers, balancing affordability with growth is paramount. For investors, identifying high-potential markets and embracing innovation are key to success. And for consumers, understanding these trends is essential to making informed decisions in a competitive market.

The real estate market in 2024 is a microcosm of broader societal and economic forces, reflecting our priorities, aspirations, and challenges. By examining these trends, we gain valuable insights into the future of real estate and its role in shaping the world we live in.